WNS (Holdings) Limited (NYSE:WNS) Position Boosted by Bank of Montreal Can

Bank of Montreal Can raised its stake in WNS (Holdings) Limited (NYSE:WNS) by 12.8% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 106,194 shares of the business services provider’s stock after acquiring an additional 12,014 shares during the period. Bank of Montreal Can owned approximately 0.21% of WNS worth $4,381,000 at the end of the most recent quarter.

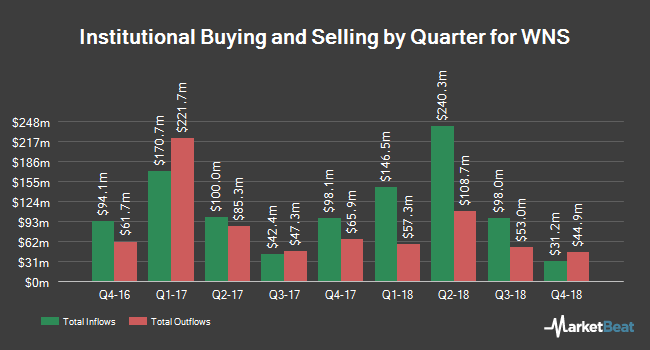

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. Advisors Asset Management Inc. lifted its stake in shares of WNS by 103.1% in the 2nd quarter. Advisors Asset Management Inc. now owns 2,738 shares of the business services provider’s stock valued at $143,000 after purchasing an additional 1,390 shares during the period. Quantbot Technologies LP raised its stake in WNS by 599.1% during the 3rd quarter. Quantbot Technologies LP now owns 3,076 shares of the business services provider’s stock worth $156,000 after buying an additional 2,636 shares during the period. Iberiabank Corp acquired a new position in WNS during the 3rd quarter worth approximately $211,000. Hsbc Holdings PLC acquired a new position in WNS during the 3rd quarter worth approximately $214,000. Finally, FDx Advisors Inc. acquired a new position in WNS during the 3rd quarter worth approximately $284,000. 83.71% of the stock is owned by hedge funds and other institutional investors

Shares of NYSE WNS opened at $53.99 on Thursday. The firm has a market cap of $2.72 billion, a price-to-earnings ratio of 29.83, a PEG ratio of 1.99 and a beta of 0.99. WNS has a 1-year low of $39.24 and a 1-year high of $54.49. The company has a debt-to-equity ratio of 0.09, a current ratio of 1.97 and a quick ratio of 1.97.

WNS (NYSE:WNS) last posted its earnings results on Thursday, January 17th. The business services provider reported $0.73 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.61 by $0.12. WNS had a return on equity of 23.78% and a net margin of 12.52%. The firm had revenue of $199.70 million for the quarter, compared to the consensus estimate of $195.32 million. During the same quarter in the prior year, the business posted $0.06 earnings per share. The business’s quarterly revenue was up 5.9% on a year-over-year basis. Analysts anticipate that WNS will post 2.18 earnings per share for the current year.

Several brokerages have recently commented on WNS. Cantor Fitzgerald reissued a “buy” rating and issued a $56.00 price objective on shares of WNS in a research note on Thursday, October 25th. Loop Capital upped their target price on WNS to $63.00 and gave the company a “buy” rating in a report on Friday, October 26th. Zacks Investment Research lowered WNS from a “buy” rating to a “hold” rating in a report on Thursday, December 27th. ValuEngine lowered WNS from a “buy” rating to a “hold” rating in a report on Wednesday, January 2nd. Finally, Barrington Research reaffirmed a “buy” rating and issued a $60.00 target price on shares of WNS in a report on Tuesday, January 15th. One equities research analyst has rated the stock with a hold rating and five have assigned a buy rating to the company’s stock. WNS has an average rating of “Buy” and a consensus price target of $58.80.

WNS Company Profile

WNS (Holdings) Limited, a business process management company, together with its subsidiaries, provides data, voice, analytical, and business transformation services worldwide. It operates through two segments, WNS Global BPM and WNS Auto Claims BPM. The company offers industry-specific services to clients primarily in insurance; travel and leisure; diversified businesses, including manufacturing, retail, consumer packaged goods, media and entertainment, and telecommunication; utilities; consulting and professional services; healthcare; banking and financial services; and shipping and logistics industries.