Quebec LNG Facility Gains Small Investment from Local Entrepreneurs

Quebec investors made a start Tuesday on filling a year-old gap left after Berkshire Hathaway Inc. walked away from the plan for French Canada to enter the global liquefied natural gas (LNG) market.

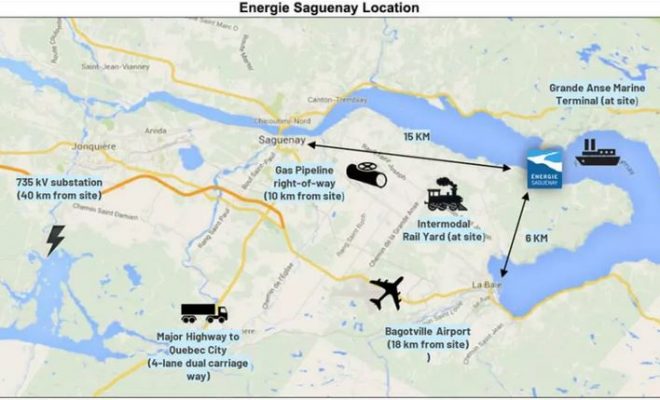

Construction contractors Cegerco and L. Fournier et fils Inc. announced a C$2 million ($1.5 million) initial participation commitment by an entrepreneur group in the region east of Montreal, where the proposed Energie Saguenay export terminal would be built.

Cegerco President Jeannot Harvey and L. Fournier proprietor Jérémi Fournier described the commitment as a message to Canadian authorities and international business that the LNG project has community support, should be approved and deserves investment.

The holding company that owns the $6.8 billion Energie Saguenay and its $3.8 billion supply pipeline, Gazoduq, also disclosed a name change to Symbio Infrastructure LP from GNL Quebec LP.

The project leaders continue to be a Delaware-incorporated partnership, Ruby River Capital, with former Bechtel executive Jim Illich and a pioneer Silicon Valley investor in Facebook, Jim Breyer, at the helm.

Symbio called the added participation by Quebec regional investors “supportive and independent validation” for an LNG venture opposed by French Canadian environmental activists and academic fossil fuel foes.

The Quebec Office of Public Hearings on the Environment is scheduled to report project review results this week to provincial Environment Minister Benoit Charette. Public release of the report is expected after two weeks of ministerial study.

The Energie Saguenay terminal would be capable of exporting 11 million metric tons/year, or roughly 1.5 Bcf/d. The project includes liquefaction equipment, storage facilities and marine shipping infrastructure.

The 1.8 Bcf/d Gazoduq pipeline is planned to feed the terminal. It would run 470 miles from Ontario to the plant, which would be east of Quebec City.